Mineral rights taxation fundamentally shapes the economics of natural stone extraction, directly impacting quarry operators’ bottom lines and property owners’ investment returns. Understanding these tax obligations for stone businesses has become increasingly critical as global demand for premium natural stone continues to rise. Complex overlapping jurisdictions, varying assessment methods, and evolving regulatory frameworks create a challenging tax landscape that requires careful navigation.

Property owners must grasp both surface and subsurface rights implications, as mineral rights taxation often operates independently from traditional property taxes. This distinction becomes particularly relevant when mineral rights have been severed from surface rights – a common scenario in established quarrying regions. The tax burden can shift significantly based on factors like extraction volumes, market values, and local tax policies.

For industry professionals, staying current with mineral rights taxation requirements isn’t just about compliance – it’s a crucial element of strategic planning and profitability. Recent changes in international trade policies and environmental regulations have added new layers of complexity to an already intricate tax structure. Understanding these nuances enables operators to make informed decisions about resource development while maintaining competitive advantages in the global natural stone market.

Understanding Mineral Rights in Natural Stone

Mineral Rights vs. Surface Rights

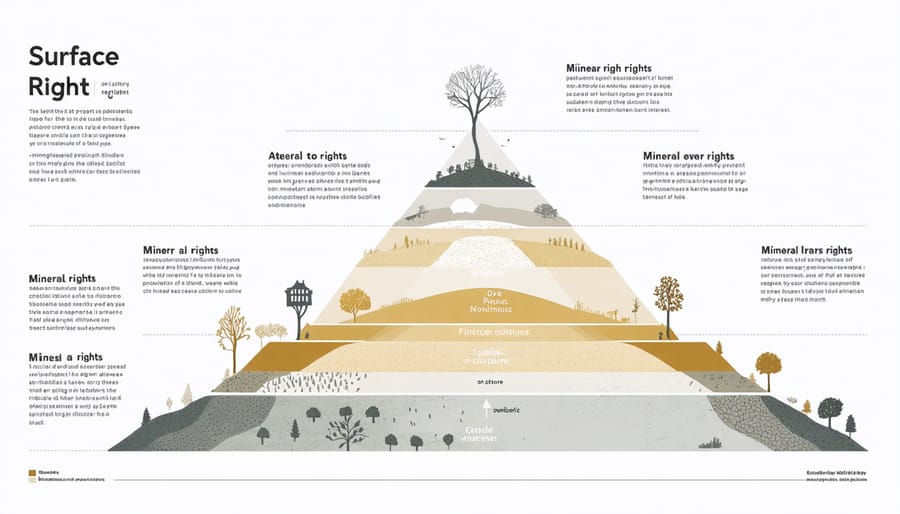

Mineral rights and surface rights represent two distinct forms of property ownership that can be separately owned and taxed. Surface rights encompass the land’s topmost layer and structures built upon it, while mineral rights cover the natural resources beneath the surface, including valuable stone deposits, metals, and other minerals.

When these rights are split, known as a “split estate,” different parties may own and be taxed on their respective rights. The surface rights owner controls the land’s use for activities like building, farming, or landscaping, while the mineral rights owner has legal access to extract subsurface resources, subject to local regulations and agreements.

This separation becomes particularly significant in natural stone quarrying operations, where mineral rights holders must often negotiate access agreements with surface rights owners. The tax implications differ for each type of ownership, with mineral rights typically being assessed based on the potential value of extractable resources, while surface rights are taxed according to land value and improvements.

Understanding this distinction is crucial for property owners and industry professionals, as it affects both operational rights and tax obligations.

State-Specific Regulations

Mineral rights taxation varies significantly across different states, with each jurisdiction maintaining its own regulations and tax structures. Texas, a major player in natural stone extraction, implements a severance tax system where quarry operators pay based on the market value of extracted materials. In contrast, California focuses on property tax assessments that include mineral rights as part of the overall land value.

Wyoming and Montana utilize a combination approach, incorporating both severance taxes and ad valorem taxes on mineral production. Colorado’s system emphasizes environmental impact fees alongside traditional taxation methods, while Oklahoma maintains a graduated tax rate based on production volumes.

States like Arizona and Nevada, rich in decorative stone deposits, have specific provisions for dimension stone quarrying operations. These states often offer tax incentives for sustainable mining practices and local processing facilities. Utah and Idaho have implemented simplified taxation systems that focus on annual permit fees rather than complex production-based calculations.

Understanding these state-specific regulations is crucial for quarry operators and property owners, as compliance requirements and tax obligations can significantly impact operational costs and profitability.

Tax Implications for Natural Stone Rights

Property Tax Assessments

Property tax assessments for lands containing mineral rights often involve complex valuation methods that consider both surface and subsurface assets. When mineral rights are attached to a property, assessors must account for the potential value of extractable resources, which can significantly impact the overall property tax burden.

The assessment process typically involves evaluating several factors, including the type and quality of minerals present, their market value, and extraction feasibility. In areas where natural stone deposits are prevalent, property owners may experience higher tax assessments due to the inherent value of these resources. However, the relationship between market volatility in natural stone and property valuations can create uncertainty in tax obligations.

Many jurisdictions use different assessment methods for severed mineral rights versus unified property ownership. When mineral rights are separated from surface rights, assessors must determine the standalone value of each component. This separation can sometimes result in lower property tax assessments for surface rights owners, while mineral rights holders face separate tax obligations based on resource potential.

Property owners should regularly review their assessments to ensure accurate valuation of their mineral rights. Some jurisdictions offer tax incentives or special classifications for properties with active mining operations or conservation easements, which can help optimize tax obligations while maintaining responsible resource management.

Severance Tax Considerations

Severance taxes play a crucial role in the natural stone industry, representing a levy imposed on the extraction of natural resources from the earth. These taxes are calculated based on either the volume of stone extracted or its market value, depending on state regulations and local jurisdictions.

For quarry operators and stone producers, severance taxes typically range from 2% to 8% of the extracted material’s value. Some states offer reduced rates for certain types of stone or specific end-uses, particularly when the material is destined for public works projects or environmental conservation efforts.

Understanding your severance tax obligations requires careful consideration of several factors:

– The type of stone being extracted

– The volume or value of extraction

– Local and state tax regulations

– Any applicable exemptions or credits

– Processing and transportation considerations

Many states require monthly or quarterly reporting of extraction activities, with tax payments due accordingly. Failure to comply can result in significant penalties and interest charges. Some jurisdictions also mandate environmental impact fees in addition to standard severance taxes.

To optimize tax liability, operators should maintain detailed extraction records, understand applicable deductions, and stay informed about changing regulations. Working with tax professionals who specialize in natural resource taxation can help ensure compliance while maximizing available benefits and exemptions.

International Trade and Tariff Impact

Import Duties on Natural Stone

Natural stone imports are subject to various tariff structures that significantly impact the industry’s economics. Currently, import taxes on natural stone vary by material type, processing level, and country of origin. For example, raw marble blocks typically face lower duty rates (around 0-3%) compared to finished marble products (up to 6.5%).

The United States maintains specific harmonized tariff schedules for different stone categories. Granite, limestone, and travertine each have distinct classification codes and corresponding duty rates. These rates can be affected by trade agreements, with some countries enjoying preferential treatment through free trade partnerships.

Recent trade policies have introduced additional complexities, including countervailing duties on certain stone products from specific regions. These measures aim to protect domestic producers while ensuring fair market competition. Importers must also consider additional fees such as harbor maintenance fees and merchandise processing fees, which can add 0.3447% and 0.3464% respectively to the total import cost.

For industry professionals, staying current with these tariff structures is crucial for accurate cost projections and competitive pricing strategies. Changes in trade policies can significantly impact material costs and ultimately affect project budgets.

Export Considerations

When exporting natural stone products, businesses must navigate complex tax implications that vary by jurisdiction and trade agreements. Export duties, value-added tax (VAT), and customs fees can significantly impact profit margins and competitive pricing in international markets.

Most countries require detailed documentation of mineral origin and value declaration for tax purposes. Exporters must maintain accurate records of extraction costs, processing expenses, and market valuations to comply with both domestic and international tax regulations.

Special economic zones and free trade agreements may offer tax incentives or reduced rates for stone exporters. However, these benefits often come with specific compliance requirements and reporting obligations. Companies should carefully evaluate these opportunities against the administrative burden they may impose.

Transfer pricing considerations are particularly important when dealing with related entities across borders. Tax authorities scrutinize these transactions to ensure fair market values are being used and appropriate taxes are being paid in each jurisdiction.

Environmental taxes and sustainability levies are becoming increasingly common in international trade. Exporters should factor these additional costs into their pricing strategies and maintain documentation of their environmental compliance measures to avoid penalties or trade restrictions.

Professional tax guidance is essential for navigating these complexities and optimizing tax efficiency while maintaining full compliance with all applicable regulations.

Maximizing Tax Benefits

Depletion Allowances

Depletion allowances represent a significant tax benefit for natural stone quarry operators and mineral rights owners. This provision allows for a deduction based on the declining value of mineral deposits as they are extracted, similar to depreciation for physical assets. The IRS typically permits a 14% depletion rate for most dimension stone operations, though rates can vary by mineral type.

Property owners can claim either cost depletion or percentage depletion, whichever provides the greater tax advantage. Cost depletion calculates the deduction based on the actual reduction of the resource, while percentage depletion uses a fixed rate applied to gross income from the property.

To qualify, the mineral extraction must generate income, and proper documentation of production volumes and revenue is essential. The depletion allowance cannot exceed 50% of the property’s taxable income, excluding the depletion deduction itself. Careful record-keeping and professional tax guidance are recommended to maximize this valuable tax benefit while ensuring compliance with current regulations.

Available Tax Credits

Natural stone operators can benefit from several tax credits and incentives designed to promote sustainable resource development and environmental stewardship. The Percentage Depletion Allowance is a significant tax benefit that enables operators to deduct a percentage of their gross income based on mineral extraction activities, typically ranging from 5% to 22% depending on the mineral type.

Environmental compliance credits are available for operators who implement sustainable mining practices and restoration projects. These credits can offset costs associated with land reclamation, water conservation, and dust control measures. Additionally, research and development tax credits may apply when developing new extraction techniques or implementing innovative processing methods.

State-specific incentives often include property tax exemptions for mining equipment and machinery, sales tax exemptions on energy used in extraction processes, and credits for workforce development programs. Some jurisdictions offer enterprise zone benefits for operations in designated development areas, which can include reduced tax rates and specialized deductions.

To maximize these benefits, operators should maintain detailed documentation of qualifying activities and consult with tax professionals familiar with the mining sector.

Understanding mineral rights taxation is crucial for anyone involved in the natural stone industry, from quarry operators to property owners. Throughout this guide, we’ve explored the fundamental aspects of mineral rights taxation, including ownership structures, assessment methods, and compliance requirements.

Key takeaways include the importance of maintaining accurate documentation of mineral rights ownership, understanding local tax regulations, and staying current with filing deadlines. Property owners should regularly review their mineral rights agreements and tax obligations to ensure compliance and optimize their tax positions.

For quarry operators and industry professionals, implementing proper record-keeping systems and working with qualified tax professionals can help navigate complex taxation requirements. Consider conducting annual audits of mineral rights holdings and tax strategies to identify potential savings opportunities and minimize compliance risks.

International operators should pay special attention to cross-border tax implications and treaty provisions that may affect their operations. Staying informed about changes in tax laws and industry regulations is essential for long-term success.

Remember that mineral rights taxation can significantly impact your bottom line. Taking proactive steps to understand and manage these obligations while seeking professional guidance when needed will help ensure compliance and financial optimization in your natural stone operations.