The two foundational principles of taxation – equity and efficiency – shape how natural stone businesses operate and grow in today’s complex market. While equity ensures fair distribution of tax burden across industry players, from small quarries to large distributors, efficiency focuses on minimizing administrative costs and market distortions. These principles directly impact pricing strategies, inventory management, and operational decisions throughout the stone supply chain. Understanding how they work together helps stone industry professionals make informed business choices while maintaining compliance with tax regulations. For architects, designers, and fabricators, these principles influence material costs, project budgets, and ultimately, the final price points presented to clients. By mastering these fundamentals, industry stakeholders can better navigate tax obligations while maintaining competitive advantage in the natural stone marketplace.

The Principle of Equity in Natural Stone Taxation

Horizontal Equity in Stone Import Duties

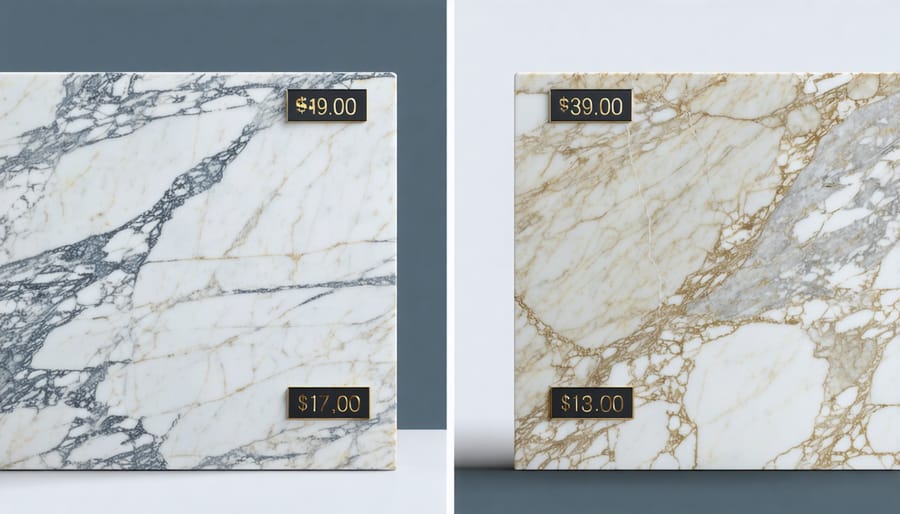

In the stone industry, horizontal equity ensures that similar stone products bear equivalent tax burdens, regardless of their origin or importer. This fundamental principle of natural stone import taxes means that marble slabs of comparable quality and dimensions from different countries should face the same duty rates.

For example, if two identical granite blocks arrive from different quarries – one from Italy and another from Brazil – they should be subject to the same import duty percentage. This fair treatment helps maintain market competition and prevents discriminatory practices that could unfairly advantage certain suppliers over others.

The classification system used for stone products carefully categorizes materials based on specific characteristics like mineral composition, finishing method, and dimensional specifications. This standardized approach ensures that similar products receive equal tax treatment, creating a level playing field for importers and maintaining market stability. Importers can rely on this consistent framework when planning their procurement strategies and calculating costs.

Vertical Equity for Premium Stone Products

In the premium stone products market, vertical equity is implemented through a progressive taxation system that considers both the quality and value of natural stone materials. Higher-grade stones, such as rare marble varieties and exotic granites, are subject to higher tax rates compared to standard stone products. For instance, luxury stones like Blue Bahia granite or Calacatta gold marble typically incur higher tax percentages due to their exceptional quality and market value.

This progressive approach ensures that premium stone suppliers and buyers contribute proportionally more to tax revenue based on their ability to pay. The system typically establishes multiple tax brackets, with rates increasing as stone quality and value rise. Basic granite might fall into a lower tax bracket, while rare onyx or specialized engineered stone products face higher rates.

The rationale behind this structure acknowledges that those dealing in high-end stone materials generally have greater financial capacity and benefit from premium market positioning. This approach helps maintain market balance while generating appropriate revenue from luxury stone transactions, ultimately supporting the industry’s sustainable development.

The Efficiency Principle in Stone Industry Taxation

Minimizing Market Distortions

Efficient taxation systems aim to minimize disruptions to natural market dynamics while generating necessary revenue. In the natural stone industry, this principle is particularly important as market forces affecting stone prices are already complex and sensitive to various factors. When tax policies are well-designed, they maintain the delicate balance between supply and demand, allowing businesses to make decisions based on genuine market conditions rather than tax implications.

For example, a proportional tax on stone products that applies equally across different varieties helps prevent artificial preferences for certain materials over others. This approach ensures that customer choices remain driven by authentic factors like quality, durability, and aesthetic appeal rather than tax-induced price distortions. Similarly, consistent taxation across different regions helps maintain fair competition and prevents market inefficiencies caused by businesses relocating solely for tax advantages.

The goal is to create a tax structure that raises revenue while preserving the natural stone market’s ability to function efficiently and respond to genuine consumer demands.

Administrative Cost Management

The efficient collection of tax revenue must balance the administrative costs against the amount generated. This principle emphasizes that the expenses incurred in collecting taxes should not outweigh or consume a significant portion of the revenue collected. In practice, this means implementing cost-effective systems for assessment, collection, and enforcement.

For tax authorities, this involves utilizing modern technology and streamlined processes to reduce operational costs. Digital filing systems, automated payment platforms, and electronic documentation have significantly lowered administrative expenses while improving accuracy and compliance rates. These innovations help minimize the resources required for tax collection while maximizing the net revenue available for public services.

However, the system must also consider compliance costs for taxpayers. Complex tax regulations and burdensome filing requirements can increase both government administrative costs and taxpayer compliance expenses. The goal is to maintain a system that is both economically efficient and practically manageable for all parties involved, ensuring that the cost of collection remains proportionate to the revenue generated.

Real-World Applications and Impact

The principles of taxation manifest clearly in the natural stone industry, where both benefit and ability-to-pay principles shape business operations and market dynamics. Large quarrying operations, for instance, often pay higher tax rates based on their revenue and extraction volumes, exemplifying the ability-to-pay principle. This graduated taxation system helps ensure that larger stone producers contribute proportionally more while smaller fabricators maintain competitive positions in the market.

Consider how tax fairness in stone industry plays out in infrastructure development. When local governments invest in road improvements near quarries, the benefit principle becomes evident as stone businesses directly utilizing these roads pay specific usage fees or higher property taxes. These contributions help maintain infrastructure critical to their operations.

Environmental taxation also demonstrates these principles in action. Quarries may pay environmental impact fees based on their extraction volume (ability-to-pay) while receiving benefits like permits and resource access. Similarly, stone fabrication facilities often pay graduated waste disposal fees depending on their production volume, linking their tax burden to both their capacity to pay and the services they receive.

Small stone retailers and installers experience these principles through sales tax collection and business licensing fees. Their tax obligations typically align with their revenue levels, while the benefits they receive – such as market access and legal protections – support their business operations. This balanced approach ensures sustainable industry growth while maintaining fair competition across different business sizes.

Understanding and applying the principles of taxation is crucial for both businesses and consumers in the natural stone industry. The principles of benefit and ability-to-pay ensure a fair distribution of tax burden while supporting infrastructure development that benefits the entire sector. By recognizing how these principles impact pricing, importing, and manufacturing of stone products, industry stakeholders can make more informed decisions and maintain compliance with tax regulations. As the natural stone industry continues to evolve, these fundamental principles remain constant guides for sustainable business practices and fair market operations. Moving forward, staying informed about tax implications helps ensure both profitability and regulatory compliance while contributing to the industry’s overall growth and development.